Which one of the following statements concerning annuities is correct? This question delves into the intricate world of annuities, exploring their nature, types, advantages, and disadvantages. Join us on this enlightening journey as we uncover the nuances of annuities and their significance in financial planning.

Annuities, financial instruments that provide a steady stream of income, offer a unique blend of security and growth potential. Understanding their complexities is crucial for making informed decisions about retirement planning and financial well-being.

1. Definition of Annuities

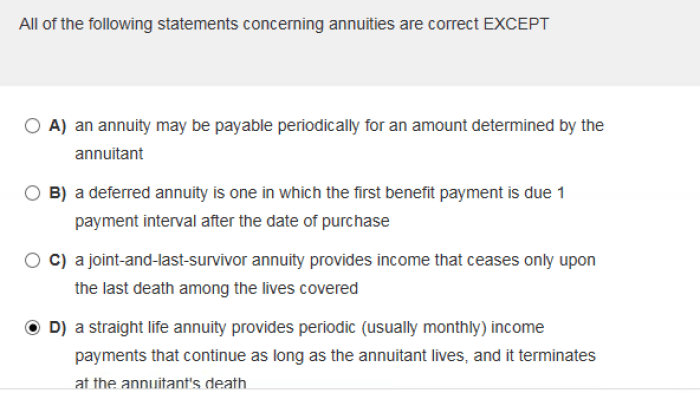

An annuity is a financial contract between an individual and an insurance company where the individual makes a lump sum payment or series of payments in exchange for a guaranteed stream of periodic payments for a specified duration or for the rest of their life.

2. Types of Annuities: Which One Of The Following Statements Concerning Annuities Is Correct

Fixed Annuities

Fixed annuities offer a fixed interest rate for a specified period, typically ranging from 1 to 10 years. The payments remain constant throughout the annuity period, regardless of market fluctuations.

Variable Annuities

Variable annuities invest in a portfolio of stocks, bonds, or other investments. The value of the annuity fluctuates with the performance of the underlying investments, potentially offering higher returns but also carrying more risk.

Indexed Annuities

Indexed annuities are hybrid annuities that combine features of fixed and variable annuities. They offer a minimum guaranteed return while also providing the potential for higher returns based on the performance of an underlying market index, such as the S&P 500.

3. Advantages of Annuities

Guaranteed Income

Annuities provide a guaranteed stream of income for a specified period or for life, offering financial security and peace of mind in retirement.

Tax Deferral, Which one of the following statements concerning annuities is correct

Annuities offer tax-deferred growth, meaning the earnings accumulate tax-free until withdrawals are made. This can result in significant tax savings over time.

Diversification

Annuities can help diversify a retirement portfolio by providing exposure to different asset classes, such as bonds, stocks, or real estate.

4. Disadvantages of Annuities

Surrender Charges

Early withdrawals from annuities typically incur surrender charges, which can be significant and reduce the value of the annuity.

Limited Flexibility

Annuities typically have limited flexibility compared to other retirement savings options, such as IRAs or 401(k) plans. Once an annuity is purchased, it may be difficult to make changes or access the funds without penalties.

Inflation Risk

Fixed annuities do not provide protection against inflation, which can erode the value of the payments over time.

FAQ Guide

What is the primary purpose of an annuity?

To provide a guaranteed income stream for a specified period or throughout the annuitant’s lifetime.

What are the different types of annuities available?

Fixed, variable, and indexed annuities, each with distinct features and risk profiles.

What are the potential advantages of annuities?

Guaranteed income, tax deferral, diversification, and potential inflation protection.

What are some drawbacks to consider before purchasing an annuity?

Surrender charges, limited flexibility, and potential inflation risk.